One of the biggest questions on everyone’s minds right now is: when will mortgage rates come down? After several years of rising rates and bouncing around in 2024, we’re all eager for relief.

While no one can project where rates will go with complete accuracy or the exact timing, experts offer insight into what we might see next year. Here’s what the latest forecasts show.

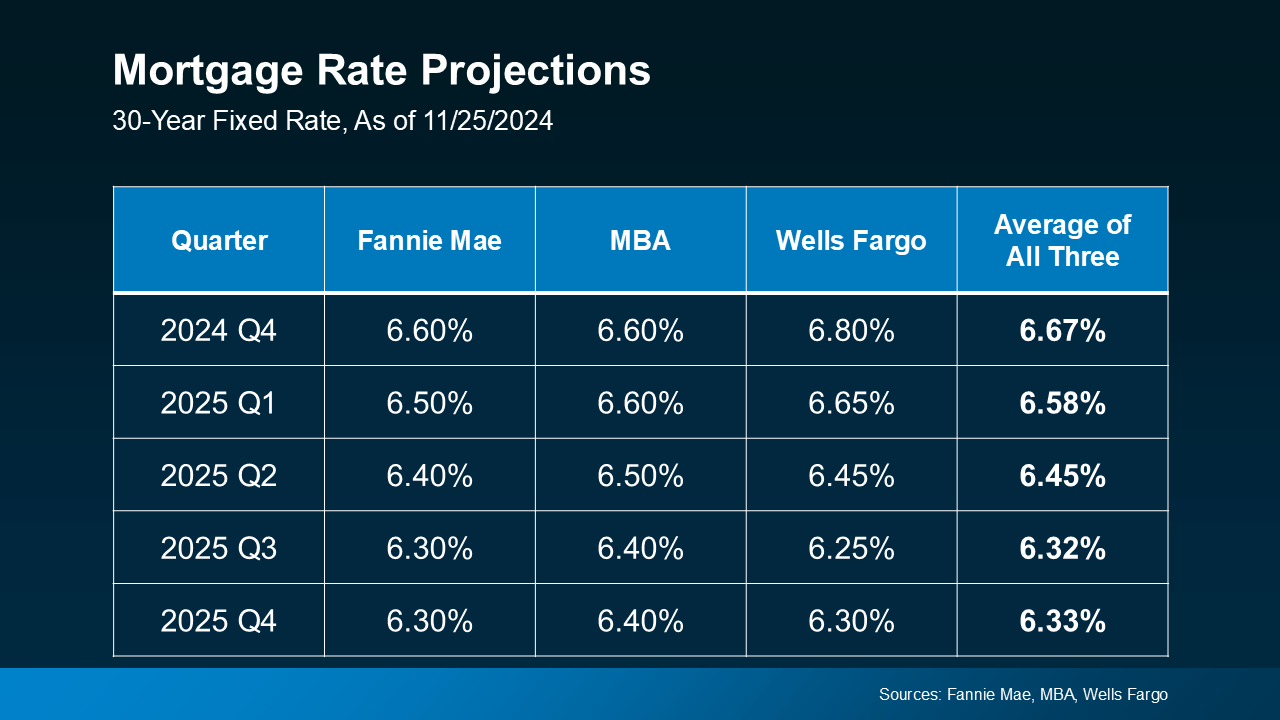

Mortgage Rates Are Expected To Ease and Stabilize in 2025

After a lot of volatility and uncertainty, the most updated forecasts suggest rates will start to stabilize over the next year and should ease a bit compared to where they are right now (see graph below):

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“While mortgage rates remain elevated, they are expected to stabilize.”

Key Factors That’ll Impact the Future of Mortgage Rates

It’s important to note that the timing and the pace of what happens with mortgage rates is one of the most challenging forecasts to make in the housing market. That’s because these forecasts hinge on a few key factors. So don’t be fooled because while rates are expected to come down slightly, they will be a moving target. And the ups and downs of ongoing economic drivers will likely stick around. Here’s a look at just a few of the things that’ll influence where they go from here:

- Inflation: If inflation cools, rates could dip a bit more. Conversely, rates may stay elevated longer if inflation rises or remains stubbornly high.

- Unemployment Rate: The unemployment rate also plays a significant role in upcoming decisions by the Federal Reserve (the Fed). While the Fed doesn’t set mortgage rates, its actions do reflect what’s happening in the greater economy, which can have an impact.

- Government Policies: With the next administration set to take office in January, fiscal and monetary policies could also affect how financial markets respond and where rates go.

Remember, these forecasts are based on the best information available right now. As new economic data comes out, experts will revise their projections accordingly. So, don’t try to time the market based on these forecasts alone.

Instead, the best thing you can do is focus on what you can control right now. Work on improving your credit score, put away any extra cash for your down payment, and automate your savings. All of these things will help you reach your homeownership goals even faster.

Be sure to connect with a trusted agent and a lender so you always have the latest updates and an expert opinion on what that means for your move.

Bottom Line

If you’re planning to move and want to stay informed about where mortgage rates are heading, let’s connect.