Are you trying to buy a home but feel you’re against deep-pocketed Wall Street investors snatching up everything in sight? Many people believe mega investors are driving up prices and buying up all the homes for sale, making it hard for regular buyers like you to compete.

But here’s the truth. Investor purchases are declining, and the big players aren’t nearly as active as you think. Let’s dive into the facts and put this myth to rest.

Most Investors Are Small, Not Mega Investors

A common misconception is that massive institutional investors are dominating the market. In reality, that’s not the case. The Mortgage Reports explains:

“On average, small investors account for around 18% of the market, while mega investors represent only about 1%.”

Most real estate investors are mom-and-pop investors who own just a few properties — not large corporations buying up entire neighborhoods. They’re people like your neighbors who have another home they rent or a vacation getaway.

Investor Home Purchases Are Dropping

But what about the big investors you hear about in the news? Lately, those institutional investors who make headlines have pulled back and aren’t buying as many homes.

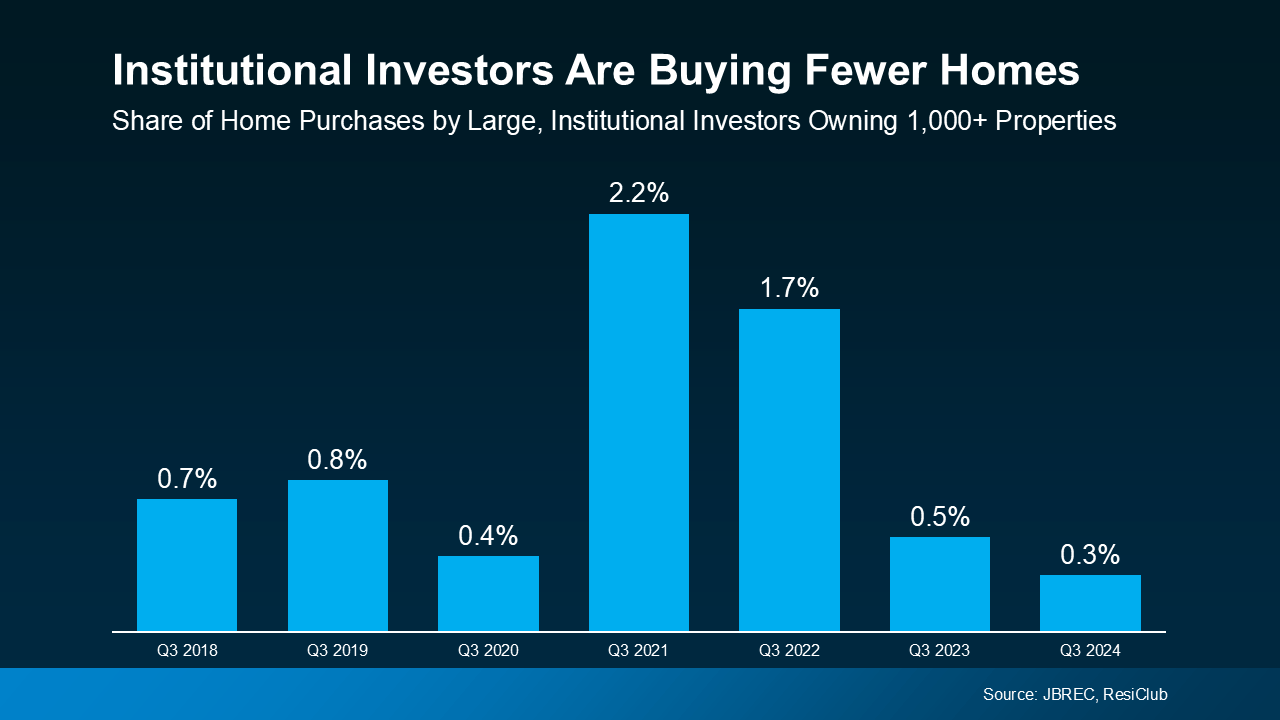

According to John Burns Research and Consulting (JBREC), at their all-time peak in Q2 2022, institutional investors (those owning 1,000+ single-family homes) only made up 2.4% of home sales. And that number has only come down since then. By Q3 2024, that number had fallen to just 0.3% (see graph below):

That’s a significant shift, meaning fewer investors are competing in the market now than just a few years ago.

That’s a significant shift, meaning fewer investors are competing in the market now than just a few years ago.

Investors are more reluctant to buy in today’s market, but why? The answer is mainly because higher mortgage rates and home prices have made it less attractive for them.

The idea that Wall Street investors are buying up all the homes and making it impossible for you to compete is a myth. While some investors are still in the market, they’re less active than in past years.

Bottom Line

Big institutional investors aren’t buying all the homes – if anything, they’re buying less than they have been. Let’s connect and talk about what’s happening in our local market. There could be more opportunities than you think.

How does knowing investors are buying fewer homes change how you see your chances in today’s market?